Filing taxes in the United States can be a daunting task, especially with the complexities of tax laws, deductions, and credits. Many taxpayers encounter various challenges that can lead to delays, errors, or even penalties. Here are some of the most common issues people face while filing their taxes and how to avoid them.

1. Filing Errors

Mistakes in tax returns are common and can result in processing delays or IRS audits. Some of the most frequent filing errors include:

- Incorrect Personal Information: Typos in Social Security Numbers (SSNs), incorrect names, or outdated addresses.

- Math Mistakes: Errors in calculations can lead to incorrect refunds or underpaid taxes.

- Wrong Filing Status: Choosing the incorrect status (e.g., Single, Married Filing Jointly, or Head of Household) can impact tax liabilities.

Solution: Double-check all information before submission and use tax software or a professional service to avoid miscalculations.

2. Missing or Incorrect Tax Forms

Taxpayers often face issues with missing or incorrect documents such as:

- W-2s and 1099s: Not receiving income statements from employers or clients can delay filings.

- Mismatched Income Reporting: The IRS matches reported income with employer filings, and any discrepancies can cause issues.

- Forgetting Side Income: Many individuals forget to report freelance income, gig work earnings, or investment profits.

Solution: Keep track of all income sources and ensure you have all necessary forms before filing.

3. Issues with Deductions & Credits

Deductions and tax credits can significantly reduce taxable income, but they can also be confusing. Common problems include:

- Claiming Incorrect Deductions: Overstating or incorrectly claiming deductions can trigger IRS scrutiny.

- Missing Out on Eligible Credits: Many taxpayers fail to claim valuable credits like the Earned Income Tax Credit (EITC) or Child Tax Credit.

- Charitable Donation Errors: Failing to provide proper documentation for charitable contributions can result in deductions being disallowed.

Solution: Research available deductions and credits, maintain documentation, and consult a tax professional if needed.

4. IRS Rejections & Delays

Some tax returns get rejected or delayed due to various reasons:

- Duplicate Returns: If someone else files using a dependent’s SSN, your return may be rejected.

- Identity Theft: Fraudulent filings using stolen personal information can cause tax complications.

- Late Filing: Missing the tax deadline leads to penalties and interest charges.

Solution: File early, secure your personal information, and check IRS notifications for any issues.

5. Tax Payment & Refund Problems

Many taxpayers struggle with:

- Owing More Taxes Than Expected: Self-employed individuals often underpay throughout the year, leading to a large tax bill.

- Refund Delays: IRS backlogs, incorrect bank details, or errors in filing can delay refunds.

- Wrong Direct Deposit Information: Entering incorrect bank details can result in lost refunds.

Solution: Use direct deposit for refunds, estimate taxes accurately, and set up a payment plan with the IRS if necessary.

6. State Tax Complications

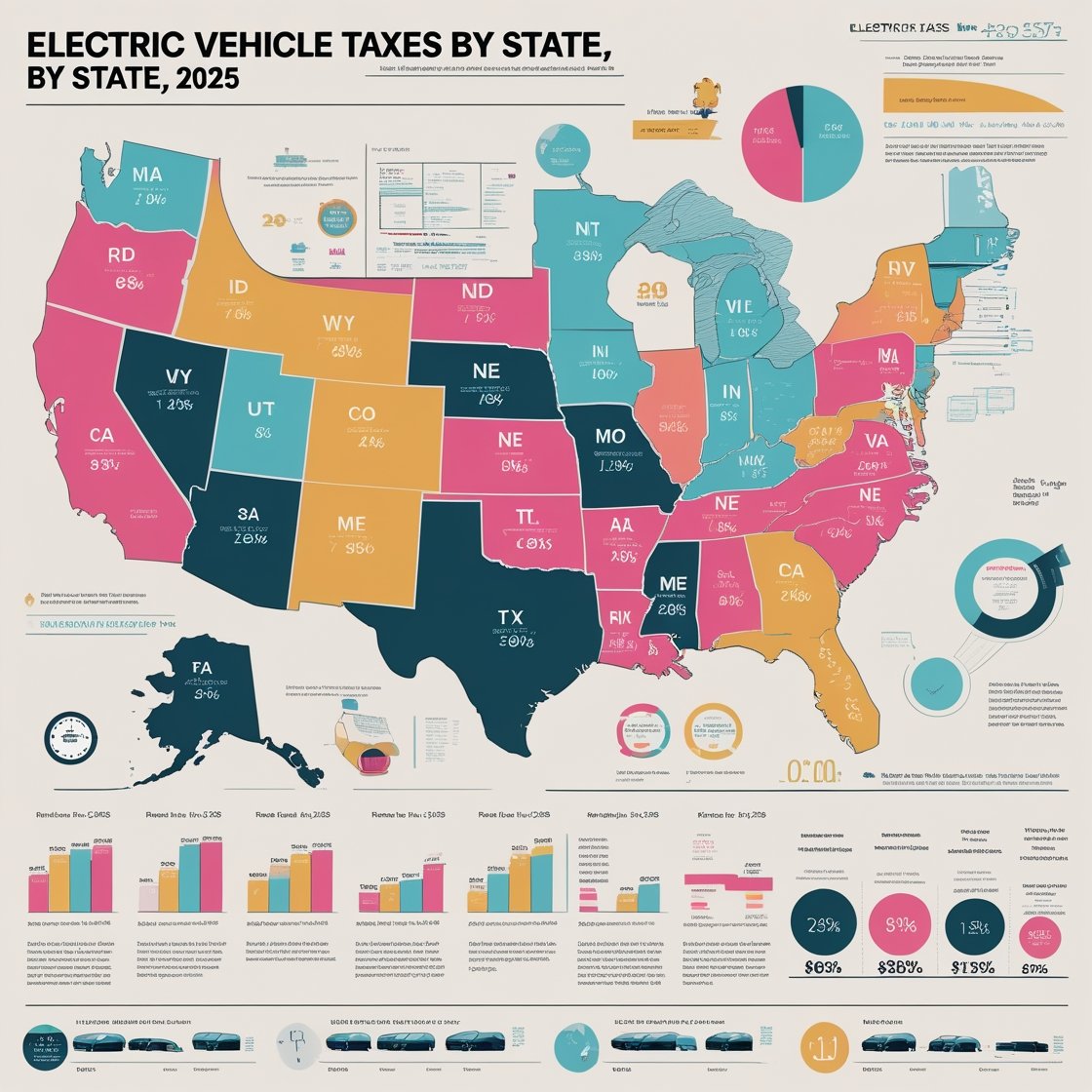

Each state has its own tax laws, leading to additional challenges such as:

- Filing in Multiple States: Remote workers and individuals who move may need to file in more than one state.

- State-Specific Deductions & Credits: Not all deductions available on federal returns apply to state taxes.

Solution: Check state tax regulations or consult a tax professional to ensure compliance.

7. Self-Employed & Small Business Tax Issues

Entrepreneurs and freelancers face additional tax hurdles, including:

- Not Paying Estimated Taxes: Self-employed individuals must make quarterly payments to avoid penalties.

- Misclassifying Workers: Small business owners must correctly classify employees vs. independent contractors.

- Improper Business Expense Deductions: Personal expenses incorrectly claimed as business deductions can trigger audits.

Contact us: +1 (972)-996-6644

Email us : info@theriwa.com Visit our website : https://theriwa.com/